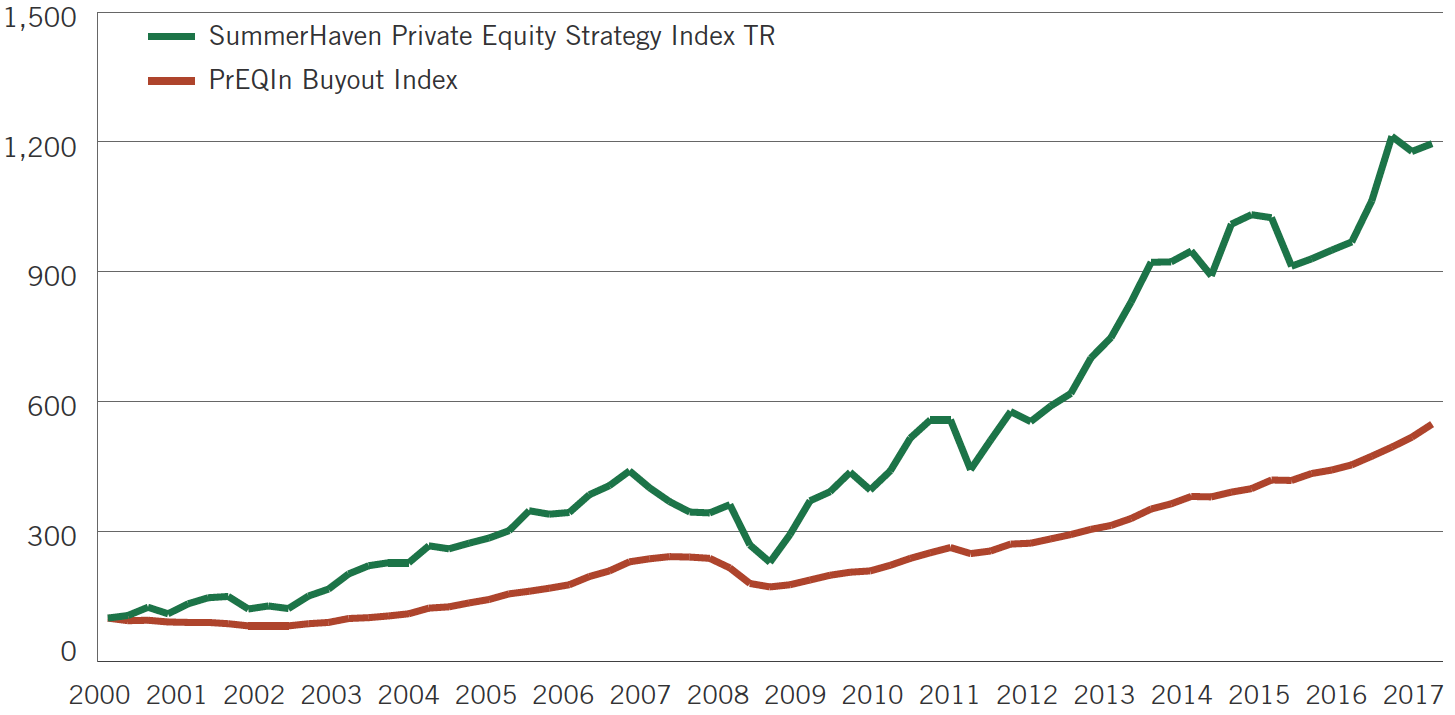

The SummerHaven Private Equity Strategy IndexSM (SHPEISM) is an innovative approach to equity investing that attempts to replicate the long-term return characteristics of a diversified private equity (“PE”) allocation. The index utilizes a systematic approach to select publicly-traded securities with the characteristics of firms that have historically been acquired by private equity funds. Contrary to a direct investment in PE, the index does not employ leverage and provides daily liquidity. The historical performance of the SHPEISM is comparable to diversified private equity benchmarks such as the Cambridge Associates LLC U.S. Private Equity Index1. The index is rebalanced annually.

Source: Preqin, SummerHaven Index Management, LLC.

The design of the SummerHaven Private Equity Strategy IndexSM builds on the work of Stafford (2017), “Replicating Private Equity with Value Investing, Homemade Leverage, and Hold-to-Maturity Accounting“. The premise of the index is that an investor is able to reproduce private equity (PE) returns by carefully choosing a portfolio of publicly-traded equities with specific characteristics as identified by Stafford (2017). Such a portfolio captures similar investment returns to PE without having to pay the takeover premium and carrying out corporate restructuring.

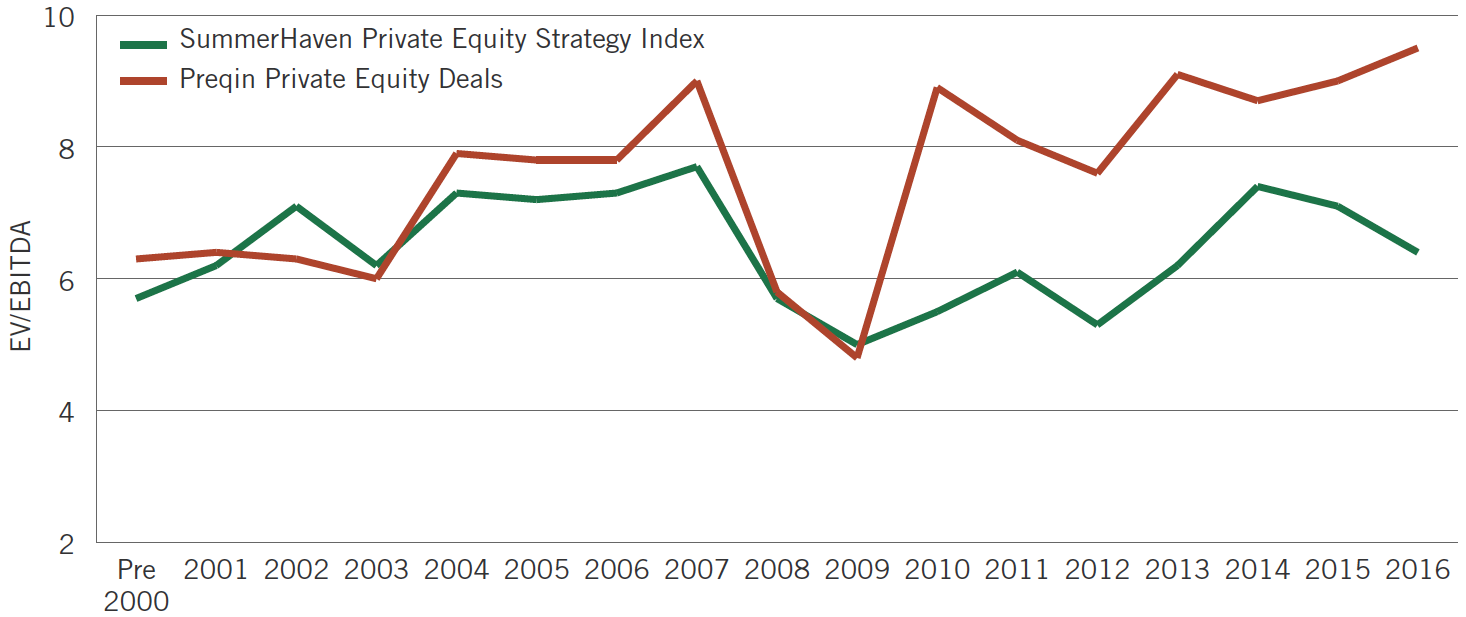

Stafford (2017) shows that the Enterprise Value (EV) to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) ratio is one of the key variables that private equity funds use to evaluate the attractiveness of a potential investment. A low EV/EBITDA indicates an attractive valuation, as the firm is trading relatively “cheaply”. By examining detailed fund data from Preqin on private equity portfolios, it can be seen that our proprietary scoring system selects equities that have similar or lower EV/EBITDA ratios compared to traditional private equity deals.

Sources: Preqin, SummerHaven Index Management

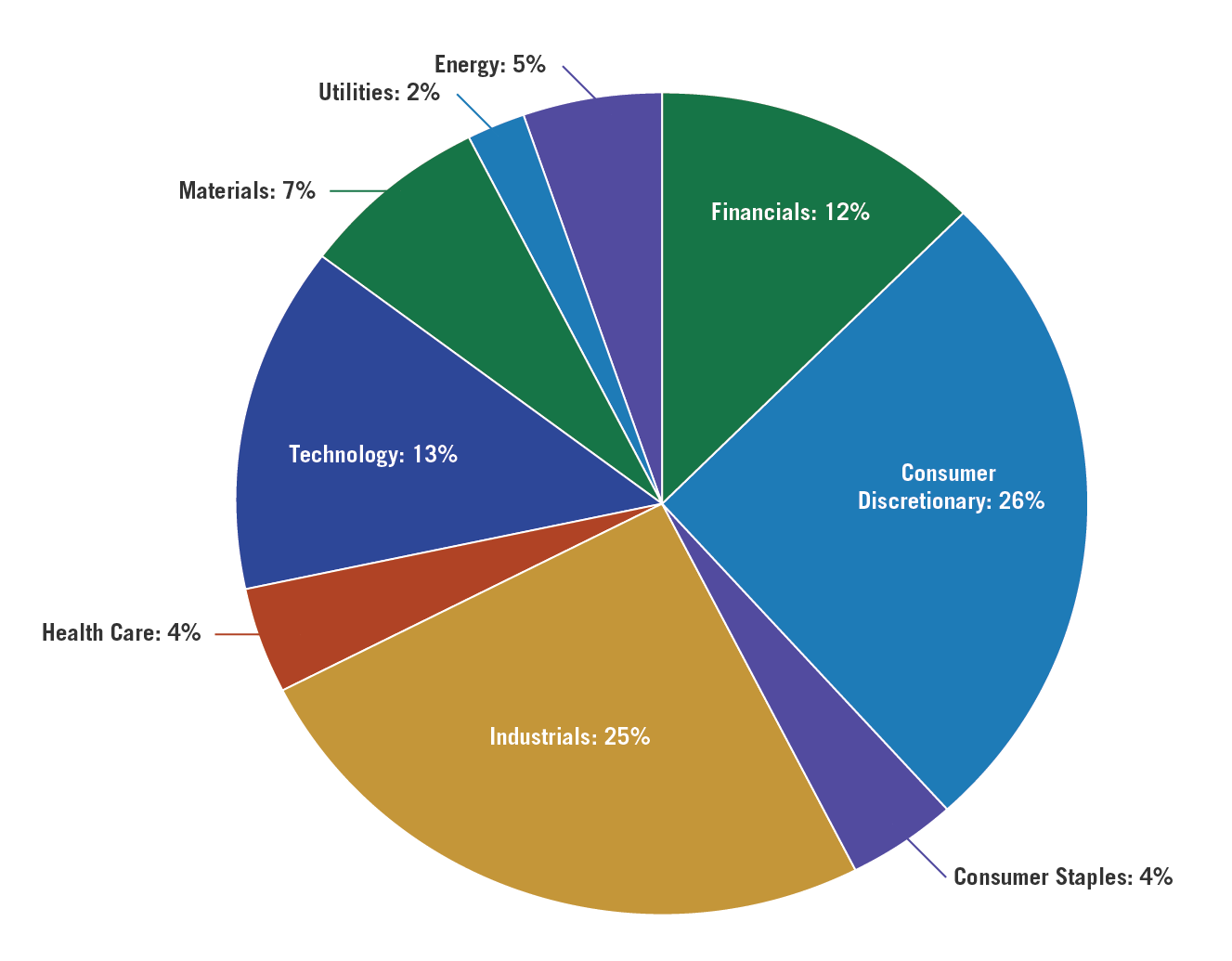

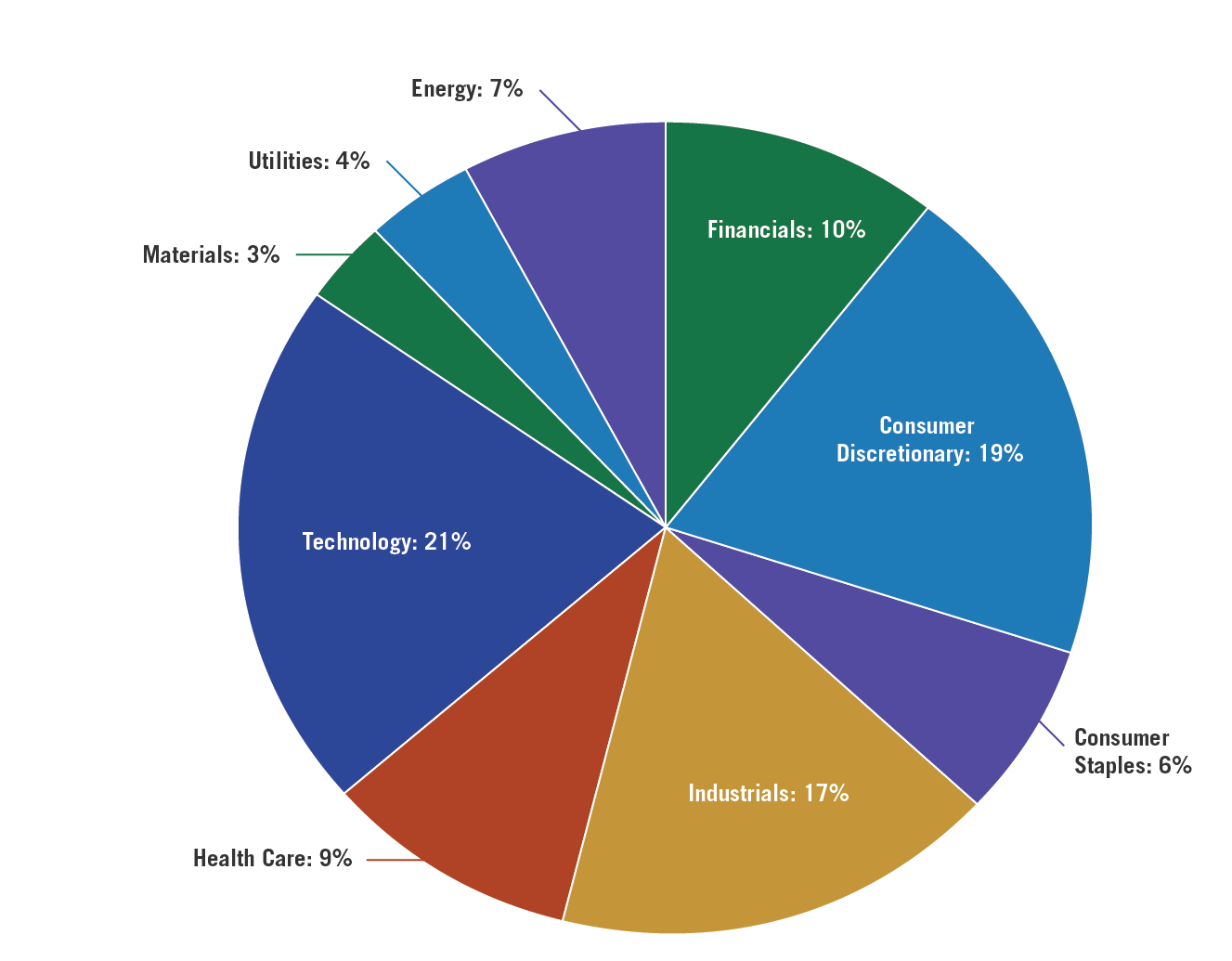

Sector allocations are broadly similar between the Preqin private equity universe and the SummerHaven Private Equity Strategy IndexSM. This is a striking observation considering that the SummerHaven Index does not select or constrain positions based on sectors membership, but rather selects securities based on their composite scores. The similarity between the sector allocations is entirely a outcome of the proprietary selection engine, which mimics the selection process of firms by private equity managers.

SummerHaven Private Equity Strategy IndexSM

Preqin Private Equity Universe

Sources: Preqin, SummerHaven Index Management

The SummerHaven Private Equity Strategy IndexSM invests in publicly-traded equities and provides comparable performance to traditional private equity. The index construction focuses on how private equity managers invest through a proprietary security selection methodology. The SHPEISM also has average sector allocations that tend to correspond closely to those of traditional private equity.

For more information, please visit www.summerhavenindex.com/contact/.

Notes: Five-year average of the sector allocation for the SummerHaven Private Equity Strategy IndexSM and the Preqin Private Equity Universe. Sector definitions are based on GICS. “Real Estate” is included as part of “Financials”, and “Technology” and “Telecommunication” has been merged into “Technology”. Five years is chosen to approximate the typical holding period of private equity deals.

1. PrEQIn Buyout Index is calculated on a quarterly basis using data from Preqin’s Performance Analyst database. The models use quarterly cash flow transactions and NAVs reported for over 3,900 individual private equity partnerships collectively worth more than $2.7 trillion. Source: Preqin