SummerHaven Dynamic Commodity Indexsm (“SDCI”)

SDCI INDEX METHODOLOGY

SDCI – INDEX PHILOSOPHY

The SummerHaven Dynamic Commodity Index (“SDCI”) was developed by SummerHaven Index Management to provide an active commodity index benchmark for investors. The SDCI is based on the notion that commodities with low inventories will tend to outperform commodities with high inventories, and that priced-based measures, such as futures basis, can be used to help assess the current state of commodity inventories1.

SDCI – INDEX CONSTRUCTION

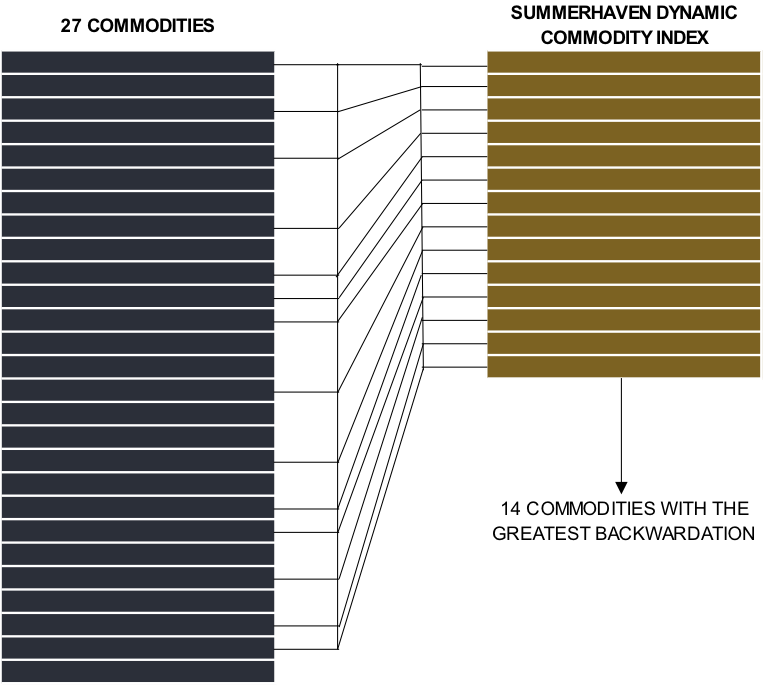

The SDCI selects 14 commodity contracts with equal weighting from a universe of 27 eligible commodities each month through three steps:

STEP 1: Commodity Selection – Backwardation

Choose 14 commodities with the greatest backwardation (or least contango). Backwardation is measured as the annualized % price difference between the futures price for the closest-to-expiration contract and the next closest-to-expiration contract for each commodity.

STEP 2: COMMODITY SELECTION – DIVERSIFICATION

SDCI requires at least one component from each of the four commodity sectors: Precious Metals, Industrial Metals, Petroleum, and Grains. If a sector isn’t represented after selecting the 14 commodities, the commodity with the highest backwardation among the commodities of the omitted sector is substituted for the commodity with the lowest backwardation among the 14 selected commodities.

STEP 3: Contract Month Selection

For each of the 14 index commodities, SDCI selects the contract month with the greatest backwardation (or least contango), taking into account the allowed contracts and maximum tenor for each commodity market.

The maximum eligible tenor is measured as the number of months starting from the maturity of the closest-to-expiration contract. The previous not withstanding, the contract expiration is not changed for that month if a commodity remains in the index, as long as the contract does not enter expiry or enter its notice period in the subsequent month.

| COMMODITY SYMBOL | COMMODITY NAME | SECTOR | ALLOWED CONTRACTS | MAX. TENOR |

| CL | Crude Oil | Petroleum | All 12 Calendar Months | 9 |

| XB | RBOB | Petroleum | All 12 Calendar Months | 4 |

| HO | Heating Oil | Petroleum | All 12 Calendar Months | 4 |

| CO | Brent Crude | Petroleum | All 12 Calendar Months | 9 |

| QS | Gas Oil | Petroleum | All 12 Calendar Months | 4 |

| W | Wheat | Grains | Mar, May, Jul, Sep, Dec | 4 |

| C | Corn | Grains | Mar, May, Jul, Sep, Dec | 4 |

| S | Soybeans | Grains | Jan, Mar, May, Jul, Aug, Nov | 4 |

| SM | Soymeal | Grains | Jan, Mar, May, Jul, Aug, Sep, Oct, Dec | 3 |

| BO | Bean Oil | Grains | Jan, Mar, May, Jul, Aug, Sep, Oct, Dec | 1 |

| LA | Aluminum | Industrial Metals | All 12 Calendar Months | 4 |

| HG | Copper | Industrial Metals | Mar, May, Jul, Sep, Dec | 1 |

| LX | Zinc | Industrial Metals | All 12 Calendar Months | 4 |

| LN | Nickel | Industrial Metals | All 12 Calendar Months | 4 |

| LL | Lead | Industrial Metals | All 12 Calendar Months | 4 |

| LT | Tin | Industrial Metals | All 12 Calendar Months | 1 |

| GC | Gold | Precious Metals | Feb, Apr, Jun, Aug, Oct, Dec | 1 |

| SI | Silver | Precious Metals | Mar, May, Jul, Sep, Dec | 1 |

| PL | Platinum | Precious Metals | Jan, Apr, Jul, Oct | 1 |

| SB | Sugar | Misc | Mar, May, Jul, Oct | 3 |

| CT | Cotton | Misc | Mar, May, Jul, Dec | 1 |

| KC | Coffee | Misc | Mar, May, Jul, Sep, Dec | 1 |

| CC | Cocoa | Misc | Mar, May, Jul, Sep, Dec | 1 |

| NG | Natural Gas | Misc | All 12 Calendar Months | 6 |

| LC | Live Cattle | Misc | Feb, Apr, Jun, Aug, Oct, Dec | 3 |

| LH | Lean Hogs | Misc | Feb, Apr, Jun, Jul, Aug, Oct, Dec | 1 |

| FC | Feeder Cattle | Misc | Jan, Mar, Apr, May, Aug, Sep, Oct, Nov | 1 |

SDCI Rebalancing:

Price observations for the steps described above are taken on the fifth-to-last business day of each month. SDCI rebalancing takes place during the last four business days of the month. At the end of each of these days one fourth of the prior month portfolio positions are replaced by an equally-weighted position in the commodity contracts determined on the selection date. At the end of the rebalancing period, the SDCI targets an equal-weight position of approximately 7.14% in each of the selected commodity contracts.

| REBALANCING START | REBALANCING END |

| Thursday, January 26, 2023 | Tuesday, January 31, 2023 |

| Thursday, February 23, 2023 | Tuesday, February 28, 2023 |

| Tuesday, March 28, 2023 | Friday, March 31, 2023 |

| Tuesday, April 25, 2023 | Friday, April 28, 2023 |

| Thursday, May 25, 2023 | Wednesday, May 31, 2023 |

| Tuesday, June 27, 2023 | Friday, June 30, 2023 |

| Wednesday, July 26, 2023 | Monday, July 31, 2023 |

| Monday, August 28, 2023 | Thursday, August 31, 2023 |

| Tuesday, September 26, 2023 | Friday, September 29, 2023 |

| Thursday, October 26, 2023 | Tuesday, October 31, 2023 |

| Monday, November 27, 2023 | Thursday, November 30, 2023 |

| Tuesday, December 26, 2023 | Friday, December 29, 2023 |

« Back

1 Geert Rouwenhorst, SummerHaven partner and Yale professor, is a recognized leader for his academic research linking commodity futures returns to inventories:

See “The Fundamentals of Commodity Futures Returns” Review of Finance (2013), pp. 35-105.