SummerHaven Private Equity Natural Resources Strategy IndexSM

The SummerHaven Private Equity Natural Resources Strategy IndexSM (SHPENSM) attempts to replicate the long-term return characteristics of a diversified natural resources private equity (NRPE) allocation through investments in publically-traded equities. The index applies the methodology of the SummerHaven Private Equity Strategy IndexSM specifically to natural resources companies in the following sector, groups, and industries:

- Energy

- Materials (agricultural chemicals, cement and aggregates, containers and packaging manufacturing, forest and paper products, metals and mining, and steel producers only)

- Industrials (transportation equipment manufacturing and machinery manufacturing only)

- Consumer discretionary (automotive manufacturing only)

- Consumer staples (agricultural products and packaged food manufacturing only)

The historical performance of SHPEN meets or exceeds those of diversified NRPE benchmarks such as the PrEQIn Natural Resources Index1, and the performance of public natural resources benchmarks such as the S&P North American Natural Resources Index2.

SHPEN has had comparable cumulative returns compared to two natural resources benchmarks: The S&P North American Natural Resources (NR) Index and the PrEQIn Natural Resources Index.

Sources: Preqin, Standard & Poor’s, SummerHaven Index Management

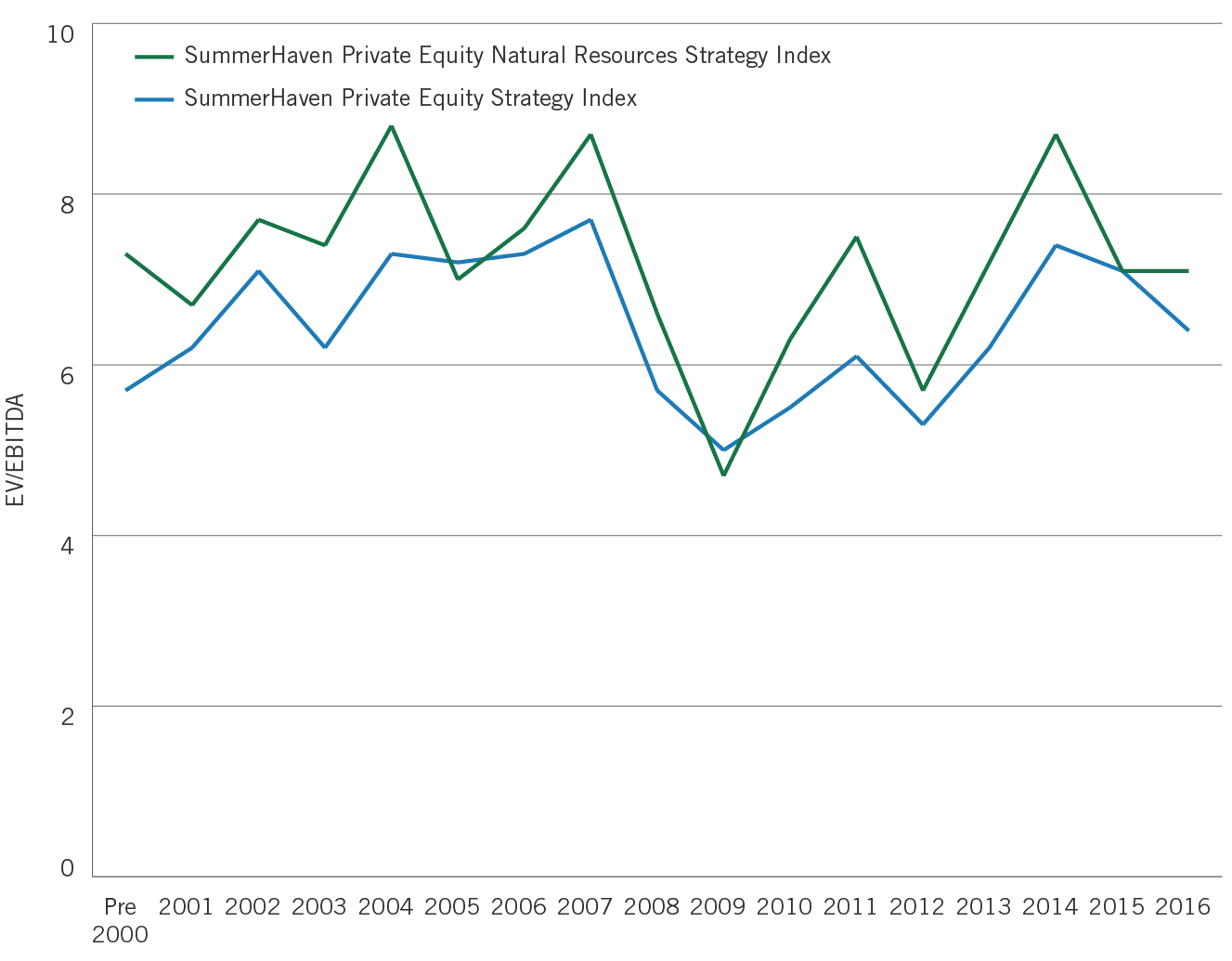

Through its security screening process, the SHPENSM selects natural resource equities with EV/EBITDA ratio similar to the SHPEISM.

Source: SummerHaven Index Management

The SummerHaven Private Equity Natural Resources Strategy IndexSM invests in publicly-traded equities and seeks to provide similar performance to the PrEQIn Natural Resources Index and the S&P North American Natural Resources Index. Like the SummerHaven Private Equity Strategy IndexSM, the SHPENSM mimics what private equity managers do through a similar proprietary selection methodology. The SHPENSM maintains its valuation discipline in the same way as the SummerHaven Private Equity Strategy Index.

For more information, please visit www.summerhavenindex.com/contact/.

1 The Preqin Natural Resources Index captures the average returns earned by investors in their natural resources portfolios, based on the actual amount of money invested in each underlying partnership. The SHPEN and the S&P North American Natural Resources Sector Total Return Index are total return indexes, with no deduction of assumed fees or expenses.

2 S&P North American Natural Resources Sector Total Return Index. Available on Bloomberg as index ticker SPGINRTR.